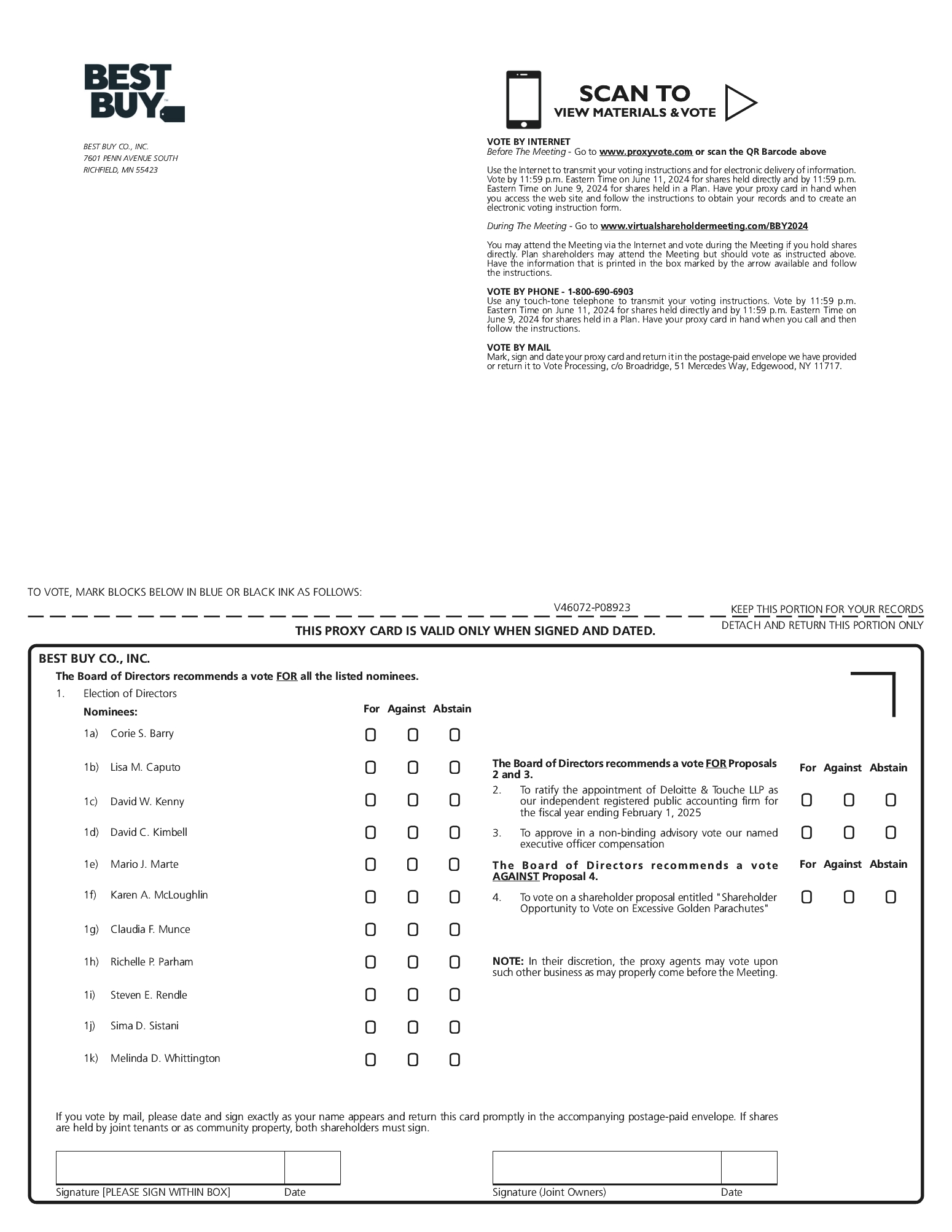

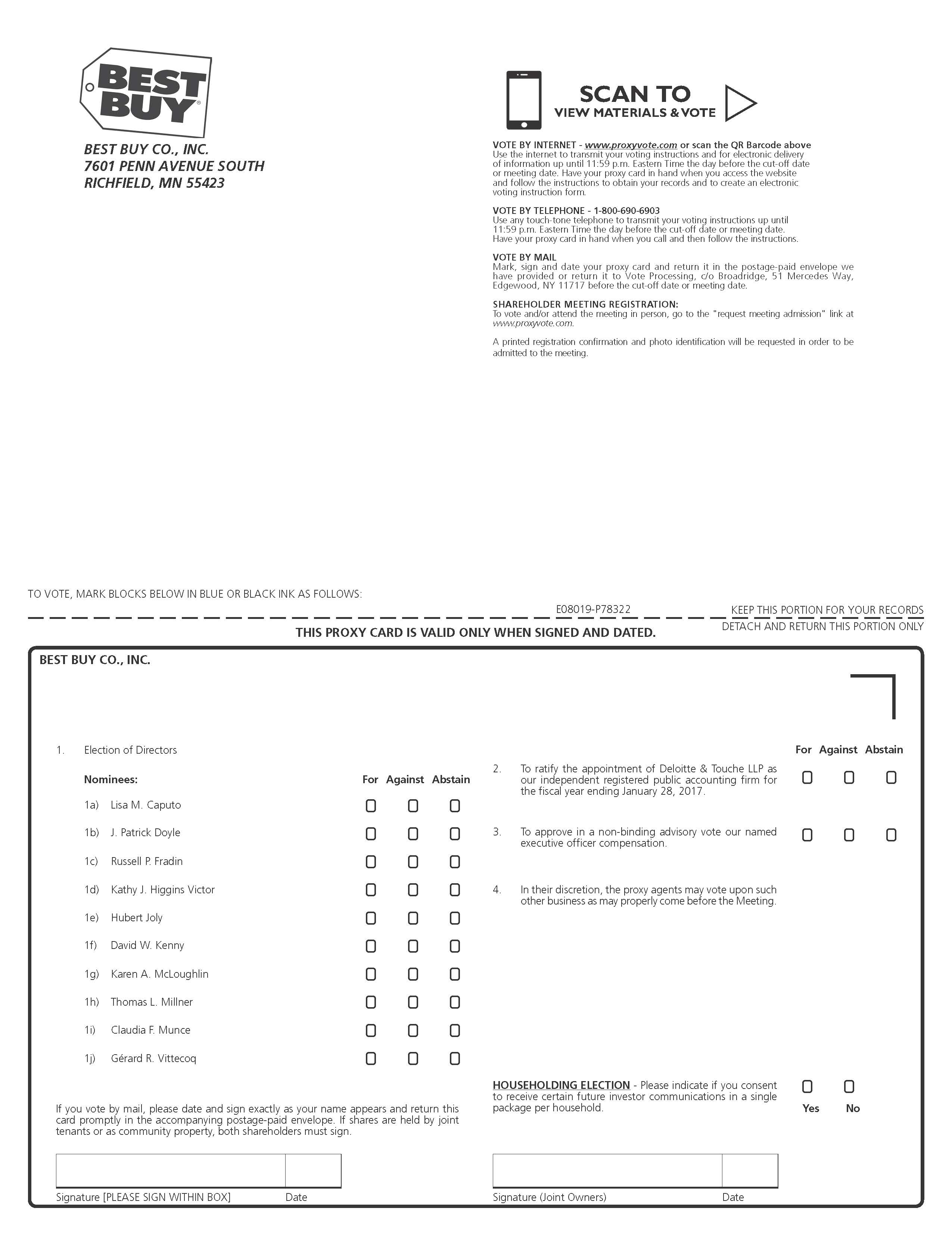

You may vote for all, some or none of the nominees for election to the Board. However, you may not vote for more individuals than the number nominated. Each of the nominees has agreed to continue serving as a director if elected. However, if any nominee becomes unwilling or unable to serve and the Board elects to fill the vacancy, the Proxy Agents named in the proxy will vote for an alternative person nominated by the Board. Our Articles prohibit cumulative voting, which means you can vote only once for any nominee. The affirmative vote of a majority of the votes cast with respect to the director is required to elect a director.

PROXY CARDS THAT ARE PROPERLY EXECTUED WILL BE VOTED FOR THE ELECTION OF ALL OF THE NOMINEES UNLESS OTHERWISE SPECIFIED.

Proxy cards that are properly executed will be voted for the election of all of the nominees unless otherwise specified.

Board Voting Recommendation

The Board recommends that shareholdersa vote FOR the election of Corie S. Barry, Lisa M. Caputo, J. Patrick Doyle, Russell P. Fradin, Kathy J. Higgins Victor, Hubert Joly, David W. Kenny, David C. Kimbell, Mario J. Marte, Karen A. McLoughlin, Thomas L. Millner, Claudia F. Munce, Richelle P. Parham, Steven E. Rendle, Sima D. Sistani, and Gérard R. VittecoqMelinda D. Whittington for a term of one year. All of the nominees are current members of the Board.

Director Nominees

The biographies of each of the nominees include information regarding the person's service as a director, business experience, public company director positions held currently or at any time during the last five years, information regarding involvement in certain legal or administrative proceedings during the last ten years if any, and the key experiences, qualifications, attributes or skills that led the Nominating Committee and the Board to determine that the person should serve as a director.

There are no family relationships among the nominees or between any nominee and any director, executive officer or person chosen to become an executive officer. There are also no material proceedings to which any director, officer, affiliate of the Company, any 5% shareholder or any associate is a party adverse to the Company or its subsidiaries or has a material interest adverse to the Company or its subsidiaries.

Director Nominees:

(Ages and Committee roles as of May 3, 2016)

|

| | | | | | | |

| Lisa M. Caputo | Best Buy Committees: | Other For-Profit Directorships (*Public Company) |

Age: 52

| | l | Compensation & Human Resources Committee | | | None |

Director Since: | | l | Nominating, Corporate Governance & Public Policy Committee | | | |

December 2009 | | | 2024 Proxy Statement | | |

| | 42 | | | | | |

| | | | | | | |

Background: Executive Vice President and Chief Marketing and Communications Officer of The Travelers Companies, Inc., a property casualty insurer (2011-present); Managing Director and Senior Banker of the Public Sector Group of the Institutional Clients Group of Citigroup, Inc., a financial services company (2010-2011); Global Chief Marketing Officer and Executive Vice President of Citigroup, Inc. (2007-2010); Founder, Chairman and Chief Executive Officer of Citi’s Women & Co., a membership service that provides financial education and services for women (2000-2011).

What she brings to the Board: Ms. Caputo’s position as Executive Vice President of Marketing and Communications of The Travelers Companies makes her critical to Best Buy’s efforts to broaden its brand, rejuvenate the customer experience and transform its marketing efforts from analog and mass to digital and personal. She also spent 11 years at Citigroup, advising three chief executive officers on topics from marketing and communications to government affairs and community relations. Ms. Caputo has an exceptional track record of enhancing corporate social responsibility and employee engagement, key components of Best Buy’s Renew Blue initiative. She has also been a senior executive at the Walt Disney Company and at the CBS Corporation, and spent more than a decade in the public sector, serving as Deputy Assistant to President Bill Clinton and Press Secretary to First Lady Hillary Rodham Clinton. Ms. Caputo’s diverse public/private background lends an important voice to the Board deliberations, particularly those that involve the Company’s efforts to communicate with customers.

Education: Ms. Caputo holds degrees from Brown University and Northwestern University.

|

| | | | | | | | |

| | J. Patrick Doyle | Best Buy Committees: | Other For-Profit Directorships (*Public Company) |

| Age: 52

| | l | Audit Committee | | l | Domino's Pizza, Inc.* |

| Director Since: | | l | Finance and Investment Policy Committee | | | |

| October 2014 | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | |

Background: President and CEO of Domino’s Pizza, Inc., the second-largest pizza company in the world (2010-present); President of Domino’s Pizza (2007-present); Executive Vice President of Team U.S.A. at Domino’s Pizza (2004-2007); Executive Vice President of Domino’s Pizza International (1999-2004); Senior Vice President of Marketing for Domino’s Pizza (1997-1999).

What he brings to the Board: Having led a remarkable transformation at Domino’s Pizza, Inc., Mr. Doyle’s experience and insights are valuable to the Board of Directors and senior management as Best Buy is in the midst of a similar effort. His experience rebuilding Domino’s reputation among consumers is a great benefit to Best Buy, particularly in its Renew Blue marketing initiatives. Under Mr. Doyle, Domino’s significantly grew its digital presence, with online orders now accounting for 40 percent of U.S. sales. That expertise supports Best Buy’s continued work in meeting customers where, how and when they want to shop — in store or online — and its goal of increasing its online market share. Mr. Doyle previously served on the board of directors of G&K Services, Inc.

Education: Mr. Doyle holds degrees from The University of Chicago Booth School of Business and from the University of Michigan.

|

| | | | | | | | |

| | Russell P. Fradin | Best Buy Committees: | Other For-Profit Directorships (*Public Company) |

| Age: 60

| | l | Compensation & Human Resources Committee (Chair) | | | None |

| Director Since: | | | | |

| April 2013 | | | | | | |

| Appointed Lead Independent Director in June 2015 |

|

Background: Operating Partner at Clayton, Dubilier, & Rice, a private investment firm (April 2016-present); Chief Executive Officer and President of SunGard, a leading software and technology services company now acquired by Fidelity National Information Services, Inc. (2011-2015); Chairman and Chief Executive Officer of AonHewitt, a global provider of human resources consulting and outsourcing solutions (2010-2011); Chief Executive Officer of Hewitt Associates (2006-2010); President and Chief Executive Officer of The BISYS Group, Inc., a provider of outsourcing solutions for the financial services sector (2004-2006).

What he brings to the Board: With experience as both a CEO and an executive board chair, Mr. Fradin is well suited to be Best Buy’s Lead Independent Director. He has firsthand insight into the partnership between an engaged Board and an effective, high-performing management team. In his role as a director, Mr. Fradin offers Best Buy the benefit of a 20-year career leading some of the country’s top services businesses, including more than a decade in a CEO role. This experience is of particular value given the Company’s emphasis on rejuvenating its services business as part of its Renew Blue transformation efforts. Additionally, Mr. Fradin’s previous leadership of Hewitt Associates and, ultimately, AonHewitt, allows him to offer valuable advice on issues that include streamlining operations, reducing costs, and establishing appropriate executive compensation. Earlier in his career, Mr. Fradin ran the Global Employer Services business of Automatic Data Processing, Inc., where he nearly doubled revenues, significantly improved margins and diversified that business’s operations. He also spent 18 years at McKinsey and Company, specializing in offering Fortune 500 clients advice on new product and services innovations. Mr. Fradin previously served on the boards of directors of SunGard Data Systems, Inc. and Gartner, Inc.

Education: Mr. Fradin holds degrees from the Wharton School of the University of Pennsylvania and from Harvard University.

|

| | | | | | | |

| Kathy J. Higgins Victor | Best Buy Committees: | Other For-Profit Directorships (*Public Company) |

Age: 59

| | l | Compensation & Human Resources Committee | | | None |

| | | | |

Director Since: | | l | Nominating, Corporate Governance & Public Policy Committee (Chair) | | | |

November 1999 | | | | | |

| | | | | |

Background: President and Founder of Centera Corporation, an executive development and leadership coaching firm (1995-present); Senior Vice President, Chief Human Resources Officer at Northwest Airlines, Inc., a global commercial airline now merged with Delta Air Lines (1991-1995).

What she brings to the Board: Ms. Higgins Victor, Founder and President of Centera Corporation, an executive development and leadership coaching firm, brings highly experienced leadership support Best Buy’s goal of developing and retaining the industry’s best talent. She uses leadership development and change management strategies to help numerous domestic and international companies build sustainable competitive advantage and has extensive experience in executive development, human resources, talent management, organizational culture, and succession planning. She led the Board’s efforts to recruit the Company’s Chairman and CEO, Hubert Joly, as well as several recent directors. Ms. Higgins Victor brings a global business perspective, having held international leadership roles with Northwest Airlines, Inc. (now Delta Air Lines), where she was responsible for executive compensation, employee benefits and labor relations, as well as a people-centric point of view gleaned from human resources-related leadership roles at The Pillsbury Company and Burger King Corporation earlier in her career. Because of her combination of decades of experience advising senior Fortune 100 executives and expertise in governance, change management and human resources, Best Buy relies on Ms. Higgins Victor to offer insight regarding its Renew Blue goal of building foundational capabilities necessary to unlock future growth strategies. She also serves on the board of trustees for the University of St. Thomas, Minnesota’s largest private university.

Education: Ms. Higgins Victor holds a degree from the University of Avila.

|

| | | | | | | |

| Hubert Joly | Best Buy Committees: | Other For-Profit Directorships (*Public Company) |

Age: 56

| None | | | | l | Ralph Lauren Corporation* |

Director Since: | | | | |

September 2012 | | | | | | |

| | | | | | |

Appointed Chairman of the Board in June 2015 |

Background: Chairman (2015-present) and Chief Executive Officer of Best Buy Co., Inc. (2012-present); President and Chief Executive Officer of Carlson, Inc., a worldwide hospitality and travel company (2008-2012); President and Chief Executive Officer of Carlson Wagonlit Travel, a business travel management company (2004-2008); senior executive positions with Vivendi S.A., a French multinational media and telecommunications company (1999-2004).

What he brings to the Board: Mr. Joly has a strong reputation as a turnaround and transformation expert. Since joining Best Buy in September 2012, Mr. Joly has led the Company’s Renew Blue transformation. As a result, Best Buy has delivered improved domestic comparable sales and profit; an increase in customer satisfaction and employee morale; an enhanced in-store experience with the addition of thousands of stores-within-a-store developed in partnership with many of the world’s leading technology companies; and a richer online shopping experience on bestbuy.com. Before joining Best Buy, Mr. Joly was CEO of Carlson, Inc., a global hospitality and travel company. He previously led Carlson Wagonlit Travel, Vivendi Universal Games and Electronic Data Systems’ French business. He began his career with McKinsey and Company, where he was a partner. Mr. Joly also serves on the boards of Ralph Lauren Corp., the Retail Industry Leaders Association and the Minnesota Business Partnership.

Education: Mr. Joly is a graduate of École des Hautes Études Commerciales de Paris (HEC Paris) and of the Institut d’Etudes Politiques de Paris.

|

| | | | | | | |

| David W. Kenny | Best Buy Committees: | Other For-Profit Directorships (*Public Company) |

Age: 54

| l | Audit Committee (Chair) | | l | SessionM |

Director Since: | l | Compensation & Human Resources Committee | | | |

September 2013 | | | | |

| | | | | | |

Background: General Manager — IBM Watson, a cognitive technology business unit of IBM, an American multinational technology and consulting corporation (January 2016-present); Chairman and Chief Executive Officer of The Weather Company, a leading provider of weather forecasts and information (2012-2015); President of Akamai, a leading cloud platform technology company (2011-2012); Managing Partner of VivaKi, a provider of integrated strategy, technology and marketing solutions for internet-based ecommerce companies (2006-2010); Founder and Chief Executive Officer of Digitas, Inc., which was later merged with VivaKi (1997-2006).

What he brings to the Board: Mr. Kenny has an impressive track record of transforming companies, a valuable asset for Best Buy’s business imperatives. He was recently appointed the General Manager of IBM Watson, tasked with overseeing the development of the company’s cognitive technology business and its related partnerships with outside software developers. As the former Chairman and Chief Executive Officer of The Weather Company (now acquired by IBM), Mr. Kenny helped turn that organization into a multi-platform media heavyweight that produced television programming, developed apps, published content and used analytics to connect businesses to consumers through weather and climate-related content. Mr. Kenny uses his consumer-centric and strategic skills to support Best Buy’s transformation efforts, including its goal of capturing online share and serving customers based on how, where, and when they want to be served. Mr. Kenny’s online leadership dates to 1997, when he founded Digitas, Inc., a provider of technology and marketing solutions for e-commerce and multi-channel companies. He previously served on the board of directors of The Weather Company, The Corporate Executive Board, Akamai Technologies and Yahoo! Inc.

Education: Mr. Kenny holds degrees from the GM Institute (now Kettering University) and Harvard University.

|

| | | | | | | |

| Karen A. McLoughlin | Best Buy Committees: | Other For-Profit Directorships (*Public Company) |

Age: 51

| l | Audit Committee | | | None |

Director Since: | l | Finance & Investment Policy Committee | |

September 2015 | | | | |

| | | | | | |

Background: Chief Financial Officer of Cognizant Technology Solutions Corporation, a Fortune 500 company and leading provider of information technology, business process and consulting services (2012-present); Senior Vice President, Financial Planning & Analysis and Enterprise Transformation of Cognizant (2008-2012); Vice President, Global Financial Planning & Analysis of Cognizant (2003-2008); Vice President, Finance of Spherion Corp., now SFN Group Inc., which was acquired by Randstadt (1997-2003).

What she brings to the Board: As the Chief Financial Officer of Cognizant Technology Solutions Corp., Ms. McLoughlin brings strong financial acumen to the Best Buy Board. Having been at Cognizant since 2003, she has developed extensive knowledge of the IT services sector, which is critical to Best Buy as it considers its own internal IT processes and continues to emphasize Services as part of its Renew Blue transformation. Further, since joining Cognizant, Ms. McLoughlin has spearheaded several critical transformational initiatives that made significant contributions to the efficiency and effectiveness of the company’s operations. Through this work, she developed a deep understanding of the company’s financial and business operations perspectives, experience that will greatly benefit Best Buy as it looks to continually improve its operational structure. During Ms. McLoughlin’s time at Cognizant, the company has experienced tremendous growth, with revenue increasing from $368 million to $10.3 billion (fiscal 2014). Prior to joining Cognizant, Ms. McLoughlin built upon her strong financial background with leadership roles at Spherion Corp. and Price Waterhouse (now PricewaterhouseCoopers).

Education: Ms. McLoughlin holds degrees from Wellesley College and Columbia University.

|

| | | | | | | |

| Thomas L. "Tommy" Millner | Best Buy Committees: | Other For-Profit Directorships (*Public Company) |

Age: 62

| l | Audit Committee | | l | Cabela's Inc.* |

Director Since: | l | Nominating, Corporate Governance & Public Policy Committee | | l | Total Wine & More |

January 2014 | | | | |

| | | | | | |

Background: President and Chief Executive Officer of Cabela’s Inc., a leading omni-channel retailer of hunting, fishing and camping products (2009-present); President and Chief Executive Officer of Freedom Group, Inc. and its successor company, Remington Arms Company, Inc., a firearms and ammunition manufacturer (1999-2009).

What he brings to the Board: As the President and Chief Executive Officerof Cabela’s Inc., Mr. Millner is a prominent presence in multi-channel retail. As the Chief Executive Officer of North America’s foremost outdoors retailer, Mr. Millner brings to the Best Buy Board expertise in support of the Company’s Renew Blue strategic priorities, particularly those concerning effective merchandizing and multi-channel operations. He has experience leading a specialty retailer through a transformation. When he joined Cabela’s, the company’s market capitalization hovered near $500 million; five years later, it exceeded $5 billion. Before leading that remarkable growth, Mr. Millner was President and Chief Executive Officer of Remington Arms Company. Earlier in his career he was Chief Executive Officer and President of Pilliod Cabinet and held various leadership positions at Broyhill Furniture and Thomasville Furniture. Experience gained throughout his career complements Best Buy’s strategy for enhanced personalized consumer marketing.

Education: Mr. Millner holds a degree from Randolph Macon College.

|

| | | | | | | |

| Claudia F. Munce | Best Buy Committees: | Other For-Profit Directorships (*Public Company) |

Age: 56

| l | Audit Committee | | l | Bank of the West |

Director Since: | l | Finance & Investment Policy Committee

| |

March 2016 | | | | | |

| | | | | | |

Background: Venture Advisor at New Enterprise Associates (NEA), one of the world’s largest and most active venture capital firms (January 2016-present); Managing Director of IBM Venture Capital Group and Vice President of Corporate Strategy at IBM Corp. (2004-15); Director of Strategy, IBM Venture Capital Group (2000-04); Head of Technology Transfer and Licensing, IBM Research (1994-2000).

What she brings to the Board: Ms. Munce is a seasoned venture capital leader who has developed a deep knowledge of global partnerships and M&A activities. Her many years of focusing on emerging markets and disruptive technology will be valuable to Best Buy as it explores growth opportunities as part of its ongoing Renew Blue transformation. She brings the perspective of someone with a highly technical engineering background as well as business acumen and a strategic mindset. Ms. Munce serves as a board member for Bank of the West, the National Venture Capital Association and Global Corporate Venturing.

Education: Ms. Munce holds degrees from the Santa Clara University School of Engineering and the Stanford University Graduate School of Business.

|

| | | | | | | |

| Gérard R. Vittecoq | Best Buy Committees: | Other For-Profit Directorships (*Public Company) |

Age: 67

| | l | Audit Committee | | l | Ariel Compressors |

Director Since: | | l | Finance & Investment Policy Committee (Chair) | | l | Vanguard Logistics Services |

September 2008 | | | | l | Mantrac Group |

| | | | | | |

| | | | | | |

Background: Group President and Executive Office Member of Caterpillar Inc., a manufacturer of construction and mining equipment (2004-2013); Vice President overseeing Europe-Africa-Middle East Product Development and Operations division of Caterpillar Inc. (2001-2004); Managing Director of Caterpillar Belgium S.A. (1997-2001).

What he brings to the Board: Mr.Vittecoq’s global perspective and international business acumen are key to the Company's work to transform its business and improve operational efficiencies. As a Group President of Caterpillar Inc., he was responsible for the development and implementation of Lean manufacturing, an effort that drove meaningful results for Caterpillar. Before he retired in 2013, Mr. Vittecoq led a strategic initiative to deliver world-class results for the company, focusing on customer expectations and driving competitive advantage, two elements crucial to Best Buy’s transformation. He is an innovator when it comes to supply chain and logistics and brings that creative, world-view thinking to Best Buy.

Education: Mr. Vittecoq holds degrees from École Supérieure de Commerce in France and Laval University in Canada.

TABLE OF CONTENTS

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table provides information about the number of shares of our common stock beneficially owned on April 13, 20161, 2024 (unless otherwise indicated), by each of our CEO, our Chief Financial Officer ("CFO"), and our three other most highly compensatednamed executive officers during the most recent fiscal year.officers. The table provides similar information for each director and director nominee, all directors and executive officers as a group, and each person, or any group that we know who beneficially owns more than 5% of the outstanding shares of our common stock.

|

| | | | | | | | | |

Name and Address(1) | | Number of Shares Beneficially Owned |

| | | | Percent of Shares Beneficially Owned |

|

| Hubert Joly, Chairman and Chief Executive Officer | | 1,903,088 |

| | (2 | ) | | * |

|

| Sharon L. McCollam, Chief Administrative Officer and Chief Financial Officer | | 441,803 |

| | (3 | ) | | * |

|

| Shari L. Ballard, President, U.S. Retail | | 425,730 |

| | (4 | ) | | * |

|

| R. Michael Mohan, Chief Merchandising Officer | | 401,101 |

| | (5 | ) | | * |

|

| Keith J. Nelsen, General Counsel & Secretary | | 253,471 |

| | (6 | ) | | * |

|

| Bradbury H. Anderson, Director | | 154,935 |

| | (7 | ) | | * |

|

| Lisa M. Caputo, Director | | 40,266 |

| | (8 | ) | | * |

|

| J. Patrick Doyle, Director | | 8,388 |

| | (9 | ) | | * |

|

| Russell P. Fradin, Director | | 17,766 |

| | (10 | ) | | * |

|

| Kathy J. Higgins Victor, Director | | 68,496 |

| | (11 | ) | | * |

|

| David W. Kenny, Director | | 13,743 |

| | (12 | ) | | * |

|

| Karen A. McLoughlin, Director | | 2,598 |

| | (13 | ) | | * |

|

| Thomas L. Millner, Director | | 12,230 |

| | (14 | ) | | * |

|

| Claudia F. Munce, Director | | 345 |

| | (15 | ) | | * |

|

| Gérard R. Vittecoq, Director | | 41,450 |

| | (16 | ) | | * |

|

| All current directors and executive officers, as a group (19 individuals) | | 3,934,777 |

| | (17 | ) | | 1.21% |

|

| Richard M. Schulze, Founder and Chairman Emeritus 3033 Excelsior Blvd., Suite 525 Minneapolis, MN 55416 | | 44,152,196 |

| | (18 | ) | | 13.64 | % |

FMR LLC ("Fidelity") 245 Summer Street Boston, MA 02210 | | 40,526,297 |

| | (19 | ) | | 11.82 | % |

The Vanguard Group 100 Vanguard Blvd. Malvern, PA 19355 | | 28,532,817 |

| | (20 | ) | | 8.32 | % |

JPMorgan Chase & Co. 270 Park Avenue New York, NY 10017 | | 28,053,911 |

| | (21 | ) | | 8.10 | % |

BlackRock, Inc. 55 East 52nd Street New York, NY 10055 | | 17,977,273 |

| | (22 | ) | | 5.20 | % |

| | Name and Address(1) | | | Number of Shares

Beneficially Owned | | | Percent of Shares

Beneficially Owned | |

| | Corie Barry, Chief Executive Officer and Director | | | 526,252(2) | | | * | |

| | Matt Bilunas, Senior Executive Vice President Enterprise Strategy and Chief Financial Officer | | | 120,780(3) | | | * | |

| | Damien Harmon, Senior Executive Vice President Customer, Channel Experiences & Enterprise Services | | | 28,265(4) | | | * | |

| | Todd Hartman, Executive Vice President, General Counsel, Chief Risk Officer and Secretary | | | 39,001(5) | | | * | |

| | Kamy Scarlett, Senior Executive Vice President Corporate Affairs, Human Resources & Best Buy Canada | | | 182,605(6) | | | * | |

| | Lisa M. Caputo, Director | | | 54,688(7) | | | * | |

| | J. Patrick Doyle, Director | | | 62,386(8) | | | * | |

| | David W. Kenny, Director | | | 40,665(9) | | | * | |

| | David C. Kimbell, Director | | | 1,756(9) | | | * | |

| | Mario J. Marte, Director | | | 8,363(9) | | | * | |

| | Karen A. McLoughlin, Director | | | 30,528(9) | | | * | |

| | Claudia F. Munce, Director | | | 28,305(9) | | | * | |

| | Richelle P. Parham, Director | | | 16,994(9) | | | * | |

| | Steven E. Rendle, Director | | | 7,827(9) | | | * | |

| | Sima D. Sistani, Director | | | 3,176(9) | | | * | |

| | Melinda D. Whittington, Director | | | 3,176(9) | | | * | |

| | Eugene A. Woods, Director | | | 15,871(9) | | | * | |

| | All current directors and executive officers, as a group (19 individuals) | | | 1,279,358(10) | | | 0.59% | |

| | Richard M. Schulze, Founder and Chairman Emeritus

999 Vanderbilt Beach Rd, Suite 710

Naples, FL 34108 | | | 21,032,995(11) | | | 9.72% | |

| | BlackRock, Inc.

50 Hudson Yards

New York, NY 10001 | | | 23,328,119(12) | | | 10.78% | |

| | The Vanguard Group

100 Vanguard Blvd.

Malvern, PA 19355 | | | 23,087,381(13) | | | 10.67% | |

| | JP Morgan Chase & Co.

383 Madison Avenue

New York, NY 10179 | | | 12,611,137(14) | | | 5.83% | |

| | State Street Corporation

State Street Financial Center

1 Congress Street, Suite 1

Boston, MA 02114-2016 | | | 11,747,443(15) | | | 5.43% | |

| |

(1)

| The business address for all current directors and executive officers is 7601 Penn Avenue South, Richfield, Minnesota, 55423. |

| |

(2)

| The figure represents: (a) 402,563281,179 outstanding shares owned by Mr. Joly;Ms. Barry; (b) 371,000 restricted stock units, which Mr. Joly could convert to3,122 outstanding shares within 60 daysheld in the name of April 13, 2016;the Trustee in connection with the Retirement Saving Plan for the benefit of Ms. Barry; and (c) 43,554 restricted shares subject to a time-based vesting schedule, which vest within 60 days of April 13, 2016; and (d) options to purchase 714,971241,951 shares, which Mr. JolyMs. Barry could exercise within 60 days of April 13, 2016.1, 2024. The figure does not include shares underlying performance share awards that are subject to vesting and settlement within 60 days of April 1, 2024. As of April 1, 2024, the threshold performance objectives for any such awards are not expected to be attained. |